During the recent synod of the Diocese of Christchurch, Edwin Boyce, the Diocesan Manager, gave a presentation on ethical investment and the way the Church invests its funds. The General Synod Office has also recently published a report (Motion 11 Report – He waka eke noa) on the investment of funds by the Anglican Church.

Currently the Anglican Church in New Zealand together holds assets of approximately $2.8 billion, including property. The wealthiest diocese is the Diocese of Christchurch, the poorest is Te Hui Amorangi Ki Te Tairāwhiti (the Māori diocese for the East Coast and Hawkes Bay). The organisation that holds the most assets is the St John’s College Trust Board. Most of the assets are held or invested on behalf of parishes by trust boards.

Apart from property (normally used for church activities) most of the assets are invested in international financial instruments to generate returns. Most Anglican organisations use negative screening and do not invest in companies with major business activity in armaments & land mines, gaming & gambling, tobacco, prostitution & pornography, alcohol, extraction and processing of fossil fuels. That avoids support for companies that do considerable harm to society. There is a long tradition among Christians of avoiding harmful investment. For example, the Quakers and also John Wesley spoke out against investment in traders and users of slaves.

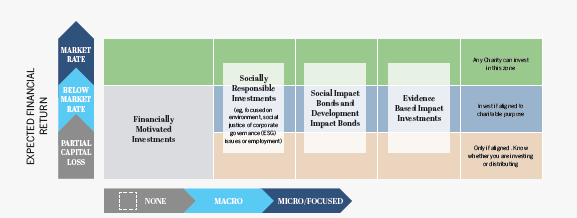

Nevertheless, some funds are still invested in companies that do not align with the church’s principles. For example, our assets support the sale and marketing of Chinese goods to American consumers. Our investments encourage rampant consumerism in far-away places. The report by the General Synod Working Group is a call to those who own, manage and steward assets within the Anglican Church to consider ways they can move toward more fruitful stewardship by way of a broader consideration of what those assets may ‘return’. There are degrees of responsible investment. Impact investment is a positive act of targeted responsible investment. Examples in recent decades include many investments in microfinance, community development finance, and clean technology. The report encourages the Church to think more like impact investors.

The Working Group challenges churches to engage in fruitful stewardship through mission aligned investment. It concludes that we should gratefully acknowledge our inheritance as today’s platform for tomorrow’s growth and thus our legacy for the future.